By Mike McGee

The biggest mistake made by President George W. Bush was that he did not insist that the US congress impose a temporary war tax or surtax as a way of financing the incursions into Iraq and Afghanistan and the international War on Terror (including Homeland Security) after September 11, 2001.

A cursory review of history shows that at least from the time of the US Civil War in 1861, a temporary war tax or surtax was imposed by the president or by congress to pay for each American war. This includes the relatively insignificant Spanish-American War, when tariffs and other taxes were raised substantially, and temporarily, to pay for that little conflict.

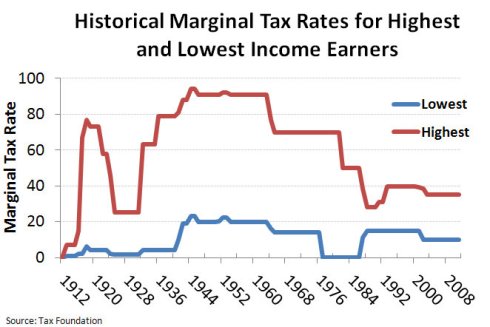

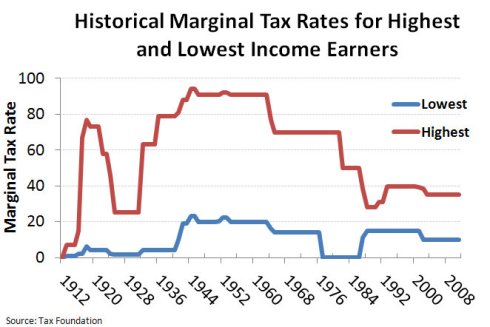

This chart shows that there were unusually high (for the times) marginal tax rates during the First World War. The top rate was increased to 91 per cent during the Second World War. The 91 per cent top marginal rate continued into the mid-sixties as we were still paying down WWII debts and paying for the Korean War.

Lyndon Johnson reduced the top marginal rate to a little over 70 per cent in about 1965, when no one yet knew the coming extent of our involvement in Vietnam. In 1969, at the height of the Vietnam War, congress forced President Lyndon B. Johnson to accept a 10% surtax on individual and corporate income, over and above the regular marginal tax rates, to help pay for the cost of fighting the Vietnam War. http://www.nytimes.com/2013/02/11/opinion/a-tax-to-pay-for-war.html?_r=0

The term “surtax” is defined as an additional tax on something that has already been taxed; it is usually highly progressive, levied on the amount by which a person’s income exceeds a specific level. Collins English Dictionary, HarperCollins Publishers, 2009.

At some point the surtax was dropped, yet to finish paying for Vietnam the top marginal rate of 70% was retained until about 1978, when Reagan wisely reduced the top rates. There was no radically unsustainable national debt from that time until George W. Bush came into office and failed to exercise the historical necessity of enacting a war tax after 9/11.

Bush may have felt he had no choice but to stand good on his conservative campaign pledge to lower taxes, and that he was caught in a trap he could not get out of, even though the whole national situation had changed after 9/11. The Republican Party would turn against him if he did like his father and reversed his pledge of no new taxes. I’m sure he had advisors who were very familiar with history and who urged him imperatively to raise taxes to pay for the war, yet he didn’t have the guts to resolutely do what history called him to do: impose a war tax.

So he ignored history, and by doing so lessened his stature as a world leader. He was not entirely at fault. He was capitulating to an increasingly business and wealth-oriented congress which had swung hard to the right.

It’s a curious thing: you’d think that those who claim to be the most ardently patriotic of our citizens would want our government to be fiscally responsible during a time of war. Sadly, this was not to be. The only sacrifices the top earners were willing to make in this war were the dead and wounded soldiers from the front lines. It seems that the emerging Tea Party and hard right Republicans were, and still are, only “summer soldiers and sunshine patriots.”

December 23, 1776, Thomas Paine:

THESE are the times that try men’s souls. The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but he that stands by it now, deserves the love and thanks of man and woman.

There are two major consequences in the years after 2001 and in the present day from George W. Bush’s failure to exercise exceptional leadership by imposing a war tax or surtax. The first is the horrific national debt our nation now carries. The second is the housing bubble and the recession of 2008. I will discuss each of these consequences separately, so that the cause and effect for each does not become conflated, and then suggest a present-day solution.

The Horrific National Debt

Here’s a chart which shows the extent to which the supposedly patriotic Republican Party, and George W. Bush in particular, are responsible for the current unsustainable national debt which is now polluting our sense of accomplishment as a nation:

Rick Seaman of Portland, Oregon, made this chart from data he found on TreasuryDirect.gov. “If voters don’t understand this, the media has failed them,” Seaman writes. This chart is not totally current, yet it illustrates perfectly the source of the current national debt. Obama has been forced to incur some more debt since this chart, due to the 2008 recession and its consequences, and his own unwillingness or inability to impose a war tax while the recession was in full swing. Still, if he hadn’t had to start from such a high base, the national debt as the wars were winding down would still be manageable in the present day.

Had a war tax on high earners and corporations, along with a temporary surtax, been instituted in 2001, we wouldn’t have the problems we have today with owing so much money to the Chinese and the Japanese. We wouldn’t be paying so much interest on the national debt. Our country’s credit rating wouldn’t have been reduced due to unsound debt practices. Our nation would not be facing the beyond extreme pressures which make people wonder if those governing the country have good sense. We would be a more secure nation, well prepared to meet the challenges of the twenty-first century.

The chart below shows that we’ve added nine trillion dollars to the national debt since 2001. The chart clearly demonstrates that 49% of this added debt is due to the wars and to the Bush tax cuts. A lot more of the new debt is due to the increased interest costs of servicing the hugely out of proportion new debt.

There is no need to say more. The evidence of the failure to embrace history speaks for itself.

The Huge Accretion of Wealth in the Hands of a Few

The period from 2001 to 2008 constitutes the greatest wealth grab in the history of mankind, by the top 1% and by the corporations. According to Grover Norquist, in his book Leave Us Alone, page 239, “Bush and a Republican Congress passed and enacted a tax cut each and every year from 2001 to 2006. In total Bush has enacted $2 trillion of tax cuts since entering office.”

These tax cuts had the actual effect of placing $2 trillion more dollars directly in the hands of the top one percent and the corporations. It was a specific movement of money away from the government and into the open and willing hands of individual men and women in the private sector. The government made up for this transfer by borrowing against the credit of the nation. This movement of money into the private sector actually may not have been so bad had there not been a war going on all during this period of monetary transfer payments to the wealthy.

These “transfer payments” to the wealthy were made especially and even more pronounced by the fact that the government was at this time borrowing to purchase war materiel and the daily goods needed by an army on foreign soil. Individuals and corporations were selling hundreds of billions of dollars’ worth of war goods to the government, thus greatly increasing their income and windfall profitability at the same time as they were receiving the transfer payments from the tax cuts.

This tremendous increase in the number of dollars stacked up in the private sector cannot properly be called inflation. “Inflation” is a rigidly defined economic term which describes increases in the cost of living for consumers and a decrease in the value of the dollar; and is usually indexed by the Consumer Price Index (CPI). There is no evidence that the huge accretion of dollars has in any way reduced the purchasing power of the dollar, as is required for inflation. Inflation was controlled very well during this whole period of the Bush presidency. Yet there were trillions of additional dollars floating around in the pockets of the wealthy and in the banks. This increase in money floating around was not limited to the United States, yet the US has paid and is still paying a heavy present price for that gigantic increase.

Since I can’t call this increase in total money “inflation,” I will suggest a new term to describe the increase: “accretion.” This marvelous accretion of the money available in the private sector meant that much of these extra trillions were, and still are, being handled by persons who were not really qualified to direct the investment and income opportunities such large sums bring on.

There had to have been hundreds of thousands of people working to spread out these additional trillions so the owners of the money would be able to make a profit from investing their new wealth. Bankers and fund managers and mortgage brokers and others, many of whom were not really bright enough to find normal ways to invest.

With so much money on the table, there was a lot of demand (money) chasing a limited supply of investments. Since the “accretion” which created this demand-pull situation did not deplete the purchasing power of the dollar, it cannot be said to be inflationary in the economic sense.

Yet it did “inflate” the egos and sense of utility of those who were the beneficiaries of this accretion. So people who were never capable of handling such sums came up with creative ways to put the money out at interest. Sub-prime mortgages paid higher percentage rates than the traditional and stuffy collateralized loans, so the unqualified agents who set them up looked good to the owners of the money.

Banks and other institutions which tried to remain “stuffy and conservative” found the accreted money being pulled out of their coffers and offered to those who were best at making promises to invest at a high rate, even without promises of adequate collateral or ability to repay.

So it is actually beyond doubt that this almost unimaginable accretion of additional money in the hands inexperienced investors, or deposited in banks or other lenders who had to use agents who were inexperienced or overly creative, chased all kinds of bad investments and set the stage for the recession of 2008.

Can We Solve This 12-Year Old Problem Now?

So the government failed to enact a war tax back in 2001 and borrowed against the full faith and credit of the US to fund the Bush tax cuts. All that is over and done, so going back in time is not an option. What can we do going forward?

Actually, we still have a war going on: the War on Terror and the war in Afghanistan. So Obama has also failed to enact a war tax after five years in office. So he should take the lead in getting a temporary war tax and surtax enacted now.

The only genuine option to solve the larger problem is for congress and the president to get together now and put in place a temporary war tax and surtax today. Enact a 70% top marginal tax rate; increase the corporate tax rate, and then add a10% surtax on all income of any kind on top of that. Any such law MUST have as a part of it a guarantee that all funds collected from the increased tax will be paid against the national debt and used for no other purpose.

One huge and messy problem that has always been a plague on the system is that when taxes are raised, the Democrats make every effort to introduce bills to increase government spending to absorb all the new tax revenues. Saying this is a little like saying that if you give a dog a bone he will want to chew on it. Increasing spending beyond current levels after enacting such a tax would be as much of a total disaster as the original Bush failure to enact a war tax.

The sole purpose of the increased tax would be to correct the problem created after 2001: it would be a war tax in every sense, and would be entirely for the purpose of paying retroactively for the wars in Iraq and Afghanistan and the War on Terror, by reducing the national debt

If the Republicans still want to be considered patriots, they will go along with such a proposal, with the understanding that wars must be paid for by the citizenry. If the Democrats still want to be considered patriots, they will agree to put in the tax bill that there will be no new spending from the temporary war tax and surtax.

Managing the government in a responsible manner is really not much of a mystery. Congress and the president have to stand up to the pressures exerted by the influential and do what history has always asked our leaders to do: pay for our wars.

From http://www.mcgeepost.com Copyright © 2013 by Michael H. McGee. All commercial rights reserved. Non-commercial or news and commentary site re-use or re-posting is encouraged. Please feel free to share all or part, hopefully with attribution.

This internet site has a whole lot great information on it, I verify on it each time Ia??m on the web. I want other web sites expended as considerably time as this one particular does generating details clearer to readers like myself. I recommend this website to all of my fb close friends. This website will make some huge passive revenue Ia??m positive.

Hello there, I discovered your web site by means

of Google while looking for a similar topic, your website got here up, it appears good.

I have bookmarked it in my google bookmarks.

Hi there, just turned intfo aware of your weblog via Google, and located that it’s truly informative.

I am gonna watch out for brussels. I will be grateful in the event

you continue this in future. Numerous people will likely be benefited from your writing.

Cheers!

It’s the best time to make some plans for the future and it’s time to be happy.

I have read this post and if I could I wish to suggest you some interesting things

or suggestions. Maybe you could write nextt articles referring to this article.

I want to read even more things about it!

bookmarked!!, I love your website!

I could not resist commenting. Well written!

Saved as a favorite, I really like your web site!

It is the best time to make some plans for the future and it is time to be

happy. I have read this post and if I could I wish to

suggest you few interesting things or suggestions.

Maybe you could write next articles referring to this article.

I wish to read more things about it!

Hello there, I found your website by means of Google at the same time as

searching for a comparable subject, your site came up, it appears to be like good.

I’ve bookmarked it in my google bookmarks.

Hello there, just changed into aware of your weblog thru Google, and located that it’s truly informative.

I am going to be careful for brussels. I’ll be grateful in

the event you continue this in future. Lots of people can be benefited out of

your writing. Cheers!

I love what you guys are up too. Such clever work and reporting!

Keepp up the good works guys I’ve incorporated you guys to my blogroll.

I always spent my half an hour to read this weblog’s posts every day along with a mug

of coffee.

I’m not sure where you are getting your information, but good topic.

I needs to spend some time learning more or understanding

more. Thanks for magnificent information I was looking for this info for my mission.

Greetings from California! I’m bored to death at work so I decided to check out your

site on my iphone during lunch break. I enjoy the information you present here and can’t wait to take

a look when I get home. I’m shocked at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, superb blog!

Hello! I’ve been reading your site for a long time now and finally got the courage to go

ahead and give you a shout out from Kingwood Texas! Just wanted to

mention keep up the great job!

Thank You so much for taking some time to explain us the how too!!!

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but apart from that, this is great blog. A great read. Ill definitely be back. : )

This is the ideal blog for anyone who would like to know about this subject. You know so much its about difficult to show with you ( not that I actually would want…HaHa ). You definitely put a new spin on a subject thats been written about for a while. Great stuff, just great! : )

It is not my first time to pay a visit this site, i am browsing

this website dailly and get fastidious information from here daily.

Very good post! We will be linking to this great content on our website.

Keep up the good writing.

It’s an remarkable piece of writing in support

of all the internet users; they will take advantage from it I am sure.